Volume 1: Beyond the Horizon: Canada's Interests and Future in Aerospace – November 2012

Part 2

Context

Chapter 2.1

Canada's aerospace industry: past and present

Few human achievements are as technologically sophisticated and exhilarating as flight, and few have so profoundly affected how people live, do business, and protect national territory.

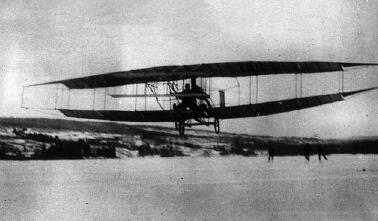

In Canada, throughout the 1890s—the decade before the Wright brothers' success at Kitty Hawk on December 17, 1903—Alexander Graham Bell had turned his genius to experimenting with kite designs as the most stable structure for an aircraft one could both power and steer, employing the young women and men of Baddeck, Cape Breton, as seamstresses, machinists, pulley operators, and photographers in his nascent aviation industry.

By 1907, Bell had formed the Aerial Experiment Association, a Canadian-American research collaboration. The team designed and built the Silver Dart, which first flew in early 1909 in Hammondsport, N.Y., and then on February 23, 1909, from the frozen surface of Baddeck Bay, making it the first piloted, powered flight of an aircraft in Canada and the British Empire. From its earliest days, the aerospace industry in Canada was a competitive but collaborative enterprise, pioneering the most advanced new technologies in international partnership, and creating employment for skilled workers—indeed, creating new skills—in anticipation of commercial application and reward.

Subsequently, industrial manufacturing in Canada was allied to interests of the industrial powers, first Great Britain and later the United States, and often undertaken in branch plants of British and American companies.

In 1938, the Canadian aerospace industry employed about 4,000 workers and produced 40 planes a year. The Second World War massively expanded Canadian aircraft manufacturing. At the peak of wartime production, the industry employed some 120,000 men and women and produced 4,000 aircraft a year.

The government formed two Crown corporations to coordinate the war effort, taking over National Steel Car as Victory Aircraft and Canadian Vickers as Canadair. Following the war, both these corporations were privatized, and the Canadian industry began to demonstrate its own design and development expertise.

and the modern Viking Twin Otter

Avro Aircraft Ltd. designed and produced the first North American passenger jet, the Jetliner, which flew in 1949 only 13 days after the maiden flight of the British de Havilland Comet, the world's first commercial passenger jet—though Avro's Jetliner never went into production as the company was directed by the Canadian government to concentrate its resources on producing the domestically designed CF-100 Canuck all-weather military interceptor. De Havilland Canada, meanwhile, specialized in small aircraft particularly suited to transport in the Canadian bush, producing the Beaver in 1947 and the Otter in 1951.

Most famously, in the mid-1950s Avro committed itself to the design and production of the CF-105 Arrow. In 1959, as a result of the government policy decision to purchase defence materiel "off the shelf" from foreign, mainly U.S., manufacturers, the Arrow project was cancelled. To compensate, the Canadian government negotiated improved access to U.S. defence markets for Canadian aerospace companies, and introduced the Defence Industry Productivity Program, which provided funds to assist Canadian firms in exploiting this new access.

With the shift away from original designs for defence contracts, the Canadian aerospace sector repositioned itself toward production for civil aviation. Pratt & Whitney Canada designed and manufactured the PT6 turboprop engine, which powered de Havilland's new Twin Otter. Canadair mainly produced jets for the Canadian military under licence from the United States, but also designed the CL-215 water bomber for use in fighting forest fires.

Other elements of the Canadian aerospace sector of the 1960s were also integrated with the U.S. aerospace industry. For example, Boeing established a parts production plant in Winnipeg. But a global recession in the early 1970s threatened the two largest Canadian aerospace manufacturers, de Havilland and Canadair, with closure.

With no other buyers interested, the federal government purchased them both—de Havilland in 1974 and Canadair in 1976—rather than forfeit the companies' expertise, potential, and manufacturing capacities, and began operating them as Crown corporations. To become profitable, each company identified a niche market in civil aviation, Canadair embarking on the design of the Challenger executive jet and de Havilland developing the Dash 7 and Dash 8 turboprop commuter planes.

The government purchase of a fleet of CF-18 Hornet fighters in 1980 buoyed the Canadian aerospace sector. Maintenance of the fleet was awarded to a consortium of firms headed by Canadair. General Electric, which built the plane's engine, established a parts manufacturing plant in Quebec, and scores of other Canadian companies benefited from the purchase in ways far removed from the procurement itself.

In 1986 both de Havilland and Canadair were privatized. Boeing bought de Havilland. Bombardier—at the time a Canadian firm specializing in ground transport vehicles such as trains and snowmobiles, and with no previous experience in aerospace—purchased Canadair.

In 1990 Bombardier announced it would design and build a regional transport jet, which resulted in its hugely successful CRJ line of aircraft. In 1992, it acquired de Havilland from Boeing, adding the company's turboprop planes to Bombardier's lines. In July 2008, it announced the launch of the CSeries, a long-range, 100-149 passenger aircraft that would compete with the smaller passenger jets manufactured by Boeing and Airbus.

Today, Canada's 700 aerospace companies generate $22 billion in annual revenues, export 80 per cent of their output, commit $1.6 billion a year to research and development, and directly employ 66,000 people, most of whom are highly skilled and educated. According to some analyses, approximately 92,000 additional jobs are generated in Canada by the aerospace sector's demand for everything from advanced metal alloys to electrical systems to training. Production is primarily oriented to the commercial market: 77 per cent of Canadian industry revenue comes from sales for civil use, compared with 46 per cent for the global industry. The aerospace manufacturing industry has a small set of very large players, with the top 19 firms representing 87 per cent of sales; in fact, Bombardier alone represents about 37 per cent of sales. The industry is home to a limited number of tier 1 system integrators, and some 670 small and medium-sized enterprises (SMEs), which are integrated into local and global supply chains.

Figure 2: Tier structure of the Canadian aerospace industry for the production of an aircraft

Geographically, the industry is concentrated in a number of regions. Montreal's aerospace cluster—which brings together a wide range of firms and academic and research institutions—is the third largest in the world and accounts for about half of all Canadian aerospace manufacturing employees. Indeed, Montreal, Toulouse, and Seattle stand apart from all other aerospace centres in terms of their sheer scale. The Canadian industry also has a strong presence in the Toronto region, and a smaller but still significant footprint in Winnipeg, Vancouver, and Atlantic Canada.

Figure 3: Regional distribution of Canadian aerospace activity—2010

R&D = research and development

Several Canadian-headquartered aerospace companies are global leaders in their markets. Bombardier is the third largest commercial aircraft manufacturer in the world, behind Boeing and the European Aeronautic Defence and Space Company (EADS), parent company of Airbus. CAE is dominant in the production of flight simulators and the provision of flight training services. Héroux-Devtek competes globally in the production of landing gear systems. Viking Air produces and maintains contemporary versions of historic de Havilland aircraft. And Magellan, Avcorp, and Noranco are providers of complex aerostructures to major aircraft manufacturers.

Canada's recognized aerospace prowess, unique position between the United States and Europe, stable business climate, and respect for diversity have enabled it to attract significant direct investment by major foreign-owned companies. Pratt & Whitney Canada, a leader in the design and production of aircraft engines, is a subsidiary of U.S.-based United Technologies Corporation (UTC). GE Aviation and Rolls-Royce have Canadian operations that support their global aircraft engine businesses. U.S.-based Textron established Bell Helicopter Textron Canada, a company that produces virtually all of Bell's commercial helicopters. General Dynamics Canada provides electronics and system integration to aircraft manufacturers, and Honeywell Canada supplies environmental control systems. Goodrich (now owned by UTC) has a Canadian facility that designs and produces landing gear. Messier-Bugatti-Dowty, which designs and manufactures landing gear systems, is owned by France's Safran. Esterline CMC Electronics and Thales Canada are leaders in the avionics sector, and are owned, respectively, by American and French parent companies. ASCO, headquartered in Belgium, designs and manufactures a variety of aircraft components at its Delta, B.C. facility. Eurocopter, owned by EADS, has a helicopter manufacturing facility in Fort Erie. Mitsubishi Heavy Industries has recently made a significant investment in Mississauga, and EADS/Aerolia has announced plans for a new facility in Montreal.

The Canadian aerospace industry has benefited tremendously from the establishment of local subsidiaries by firms from abroad, and its vibrancy can be enhanced by additional foreign direct investments, particularly in areas where the sectoral structure needs to be strengthened, such as tier 1 capacity.

In addition to a strong manufacturing industry, the Canadian aerospace sector has a record of achievement in the civil and military maintenance, repair, and overhaul (MRO) business. The MRO segment includes a mix of independent service providers, such as StandardAero, Cascade, Vector, L-3 MAS, Provincial Aerospace, IMP Aerospace and Defence, Field Aviation, and Kelowna Flightcraft; aircraft systems manufacturers with MRO operations, such as Héroux-Devtek and Pratt & Whitney Canada; and aircraft operators with MRO divisions, such as Air Georgian, Harbour Air, and Discovery Air.

The industry, in all its sub-sectors, draws engineers and skilled workers from universities and colleges across Canada—some 30 of which have departments and programs dedicated specifically to aerospace—and has one of the most highly skilled and productive workforces in the world. Wages in the industry are relatively high: the average salary for all employees in aerospace manufacturing is about $63,000, while the average across all manufacturing sectors is $51,000.

The Canadian aerospace sector, then, has a long and impressive history, and is today not only one of Canada's proudest accomplishments—an emblem of what this country and its people are capable of—but also an engine of technological innovation and economic growth. However, the industry was built in a time when there was a limited number of competitor nations, when Canadian companies enjoyed significant technological leads over foreign firms, and when our geographic proximity and relationship with the United States were a distinct advantage that could be readily leveraged.

All that has changed, and changed rapidly. New market and production realities lend urgency to efforts to advance the competitiveness of the Canadian aerospace sector. For Canada to remain an aerospace power, the government must move with focus and determination to modernize policies and programs. That done, industry, researchers, and others must step up.